MARKET WATCH: BOC 1% Rate Increase

July 13th, 2022

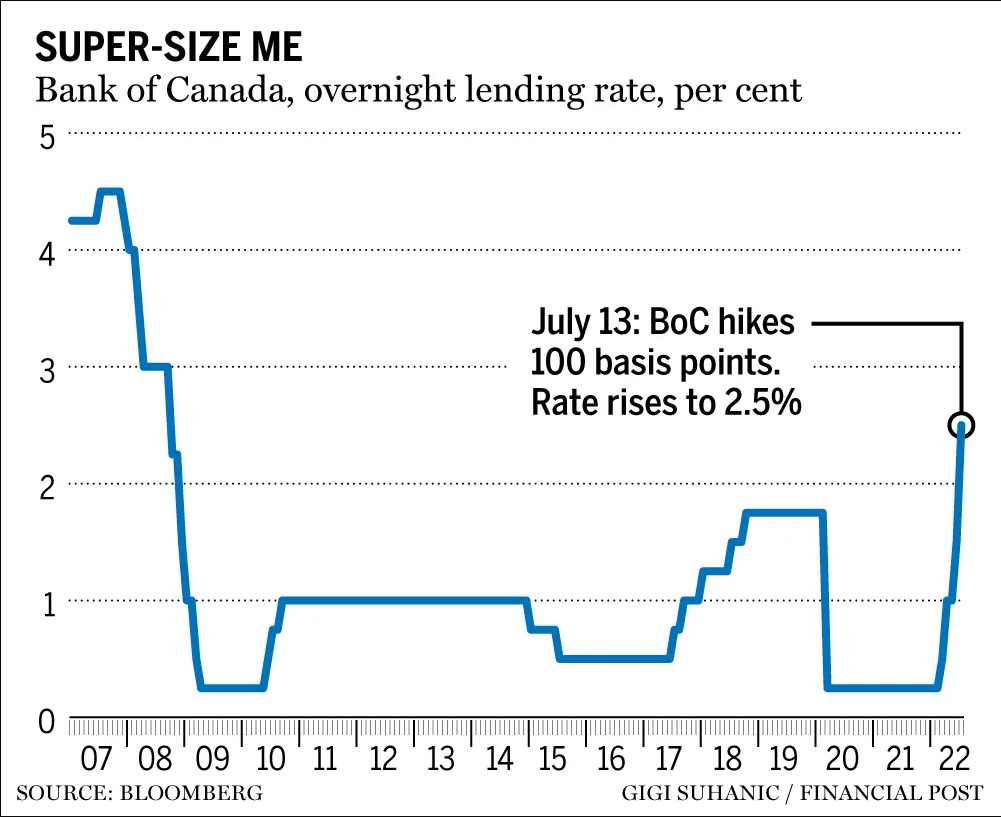

The Bank of Canada increased the policy interest rate by 1%, an increase that exceeded expectations and the largest since 1998, as the bank attempts to control high inflation.

The Bank is stating that inflation in Canada is higher and more persistent than expected and will likely remain around 8% for the next few months. The biggest drivers are the war in Ukraine, ongoing supply disruptions and excess demand in the Canadian economy. "With the economy clearly in excess demand, inflation high and broadening, and more businesses and consumers expecting high inflation to persist for longer, the Governing Council decided to front-load the path to higher interest rates by raising the policy rate by 100 basis points today," the bank stated. It also indicated that more hikes are to be expected at a pace guided by the Bank’s ongoing assessment of the state of the economy and inflation.

The Bank of Canada rate affects the cost of borrowing for various loans, including variable rate mortgages and lines of credit. If you have any questions about the impact of the Bank's rate hike on your mortgage, your mortgage payments or if your mortgage is coming up for renewal soon, please reach out to me.

The next Bank of Canada announcement is scheduled for September 7th, 2022. I’ll make sure to keep you informed.

Of course, if you have any questions regarding your mortgage, interest rates, or anything real estate related please do no hesitate to give me a call or email.

Posted by Greg Dewar on

Leave A Comment