IN THE NEWS

A quick look at the stories that are affecting our local real estate market. [June 30th, 2022]

OSFI makes real estate loan changes aimed at reducing lender risk

Canada's banking regulator is tightening requirements for some types of real estate loans to protect homeowners who may be at greater risk from higher interest rates.

The Office of the Superintendent of Financial Institutions says changes affect combined loan plans like reverse mortgages or loans with shared equity features, which have grown in popularity in recent years but may be riskier for lenders.

For borrowers who owe more than 65 per cent of the loan value, a portion of their payment must to go toward the loan principal rather than to interest until they bring the loan below that threshold.

OSFI says the changes will generally take effect the next time borrowers renew their plans after the end of fall 2023, in line with the lender’s fiscal year.

The regulator says consumers will not see an increase to their monthly payment requirements as a result of this change, nor will the move impact new homebuyers.

Bank of Canada data shows combined loan plans that are above 65 per cent loan to value account for $204 billion of the country's $1.8 trillion in total outstanding residential mortgages.

Canadian Home Prices Expected to Drop 19% By 2023: TD

June 29, 2022 - storeys.com

As higher interest rates continue to squeeze spending power — and rising inflation shows no indication of slowing — Canadian home prices and sales will dip considerably, according to the nation’s largest lender.

TD Bank has officially downgraded their forecast for the housing market compared to their take in March, due to monetary policy tightening at a faster-than-expected rate. The Bank of Canada (BoC) has implemented three hikes to its trend-setting Overnight Lending Rate (OLR) since March, bringing the benchmark cost of borrowing to 1.5% from the record-low 0.25% it had hovered at throughout the pandemic. As consumer lenders base their Prime cost of borrowing on this rate, qualification thresholds and payments have risen markedly for variable mortgages and line of credit products.

TD expects the OLR to rise an additional 1.75% before the central bank finishes its hiking cycle, hitting a termination point of 3.25% by the last quarter of this year.

That’s going to continue to weigh heavily on housing activity, says the bank, which now forecasts a 33% “peak-to-trough” decline in Canadian home sales from Q1 2022 to Q1 2023, before buying activity starts to stabilize. In all, sales will drop 23% on an annual basis this year, and 12% next.

That will result in a 19% drop in average home prices over the same time frame. “However,” states TD’s release, home prices are “likely to grow modestly thereafter, alongside some recovery in demand.”

According to the Canadian Real Estate Association, national home sales have cooled rapidly since the BoC’s first hike, with activity dropping 21.7% year over year, and 8.6% month over month, in May. Prices fell 4.6% from April to an average of $711,116; more than a $100,000-decline from the price peak recorded in February.

TD expects the largest price drops will be felt in Ontario and British Columbia, as home value return closer to fundamentals following “significant affordability deteriorations during the pandemic,” while Quebec will see price growth, though modest, following its own price run up in early 2020.

The Prairie provinces, however, are set for a considerable correction. In Alberta, “sales are expected to retrench significantly from their record highs. However, they should remain closer to pre-pandemic levels than either B.C. and Ontario through 2023, supporting tighter markets and stronger price growth.”

The ‘wild rose’ province has experienced a dramatic uptick in demand over the last couple of years, popular with both investors and end-user homebuyers for its relatively lower average home price, compared to Canada’s other large urban centres; benchmark home prices in Calgary and Edmonton are in the $400,000 – $600,000 range, in contrast to over $1.2M in Greater Toronto and Greater Vancouver.

Other Canadian provinces, however, can expect a smoother ride given their overall better affordability conditions; strong population growth and a tight sellers’ market in the Atlantic provinces will support local prices, though rising rates could make a dent moving forward.

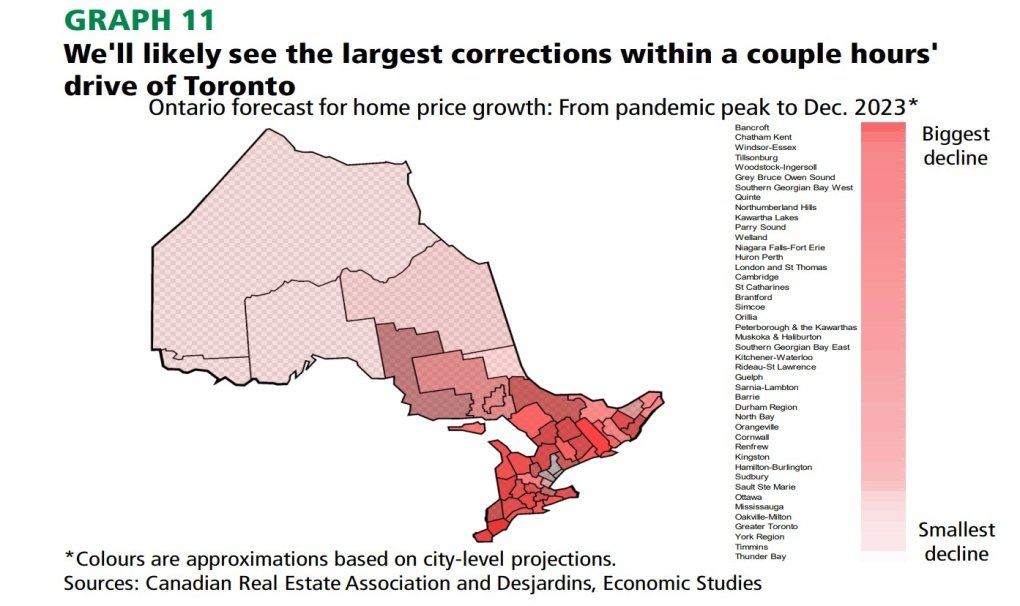

These are the areas where Ontario housing prices could see the biggest drop

June 15, 2022 - ctvnews..ca

Ontario’s housing market has been red hot for years now, but that may soon change, and some areas could be hit harder than others.

A new report by Canadian financial services cooperative Desjardins said the Canadian housing market has reached “an inflection point."

Since the Bank of Canada began to raise interest rates in order to combat inflation, home prices have steadily declined. Desjardins says that average price of a home in Canada fell 2.6 per cent month-to-month in March and 3.8 per cent in April.

These decreases should continue, the report says, and will be experienced most significantly in Ontario where housing prices could decline as much as 18 per cent.

"We expect the housing market correction in Ontario to be led by a decline in sales activity and prices in smaller centres outside of major urban areas," the report reads.

"We think prices will fall the most in communities that saw the biggest price increases during the pandemic and therefore the most erosion in affordability."

As a result, multiple areas just a few hours outside of Toronto are set to see prices drop, the report claims.

Of these regions, Bancroft could see the biggest price drop, followed by Chatham Kent and Windsor-Essex, the report said.

Toronto real estate agent Desmond Brown told CTV News Toronto he “always thought the first communities to feel downward prices were going to be the outlying communities around Toronto.”

“The sustainability of the prices we were seeing was completely unrealistic,” Brown said.

Because of this, he estimates that prices in these regions could soon drop to pre-pandemic levels.

Stay in the know, subscribe to The Inside Scoop

Want to keep up to date with all the latest local real estate news? Subscribe to The Inside Scoop, the weekly newsletter delivered straight to your inbox every Sunday.

Got questions? We got answers.

Things have been changing fast, and you likely have a lot of questions about the current real estate market.

We know that big changes can be overwhelming and confusing, especially when the media tells a different story every other day.

That's why our goal is to not just help you find the best solution for you and your family but to give you information and support along the way.

Let us help, Dewar Realty is here for all of your real estate needs.

Posted by Greg Dewar on

Leave A Comment